AI-powered platform to streamline group life insurance pricing workflows for metlife

Role — Lead Designer

Company — Kyndryl

Client — Metlife

Duration — July - Dec 2025

Team — Insurance SMEs, Account Manager, 1 SWE, 1 Cloud Architect

Problem

Actuaries doing group life pricing spend 30% of their time on data cleanup and formatting. Critical cases sat in chronological queues while urgent risks went unnoticed. Precedent was buried in folders, forcing teams to duplicate analysis or price blind.

Pricing decisions stalled. Revenue opportunities slipped away.

Strategy

Research revealed the real bottleneck wasn't modeling—it was everything before it. Teams needed intake automation, intelligent triage, and instant access to precedent so they could focus on judgment, not paperwork.

This led to AI-first workflows—where the system does the grunt work and actuaries make the decisions.

Outcomes

60-70% reduction in manual data cleanup and formatting time.

3x faster quote turnaround for complex or high-risk cases.

70% fewer broker follow-ups and coordination loops.

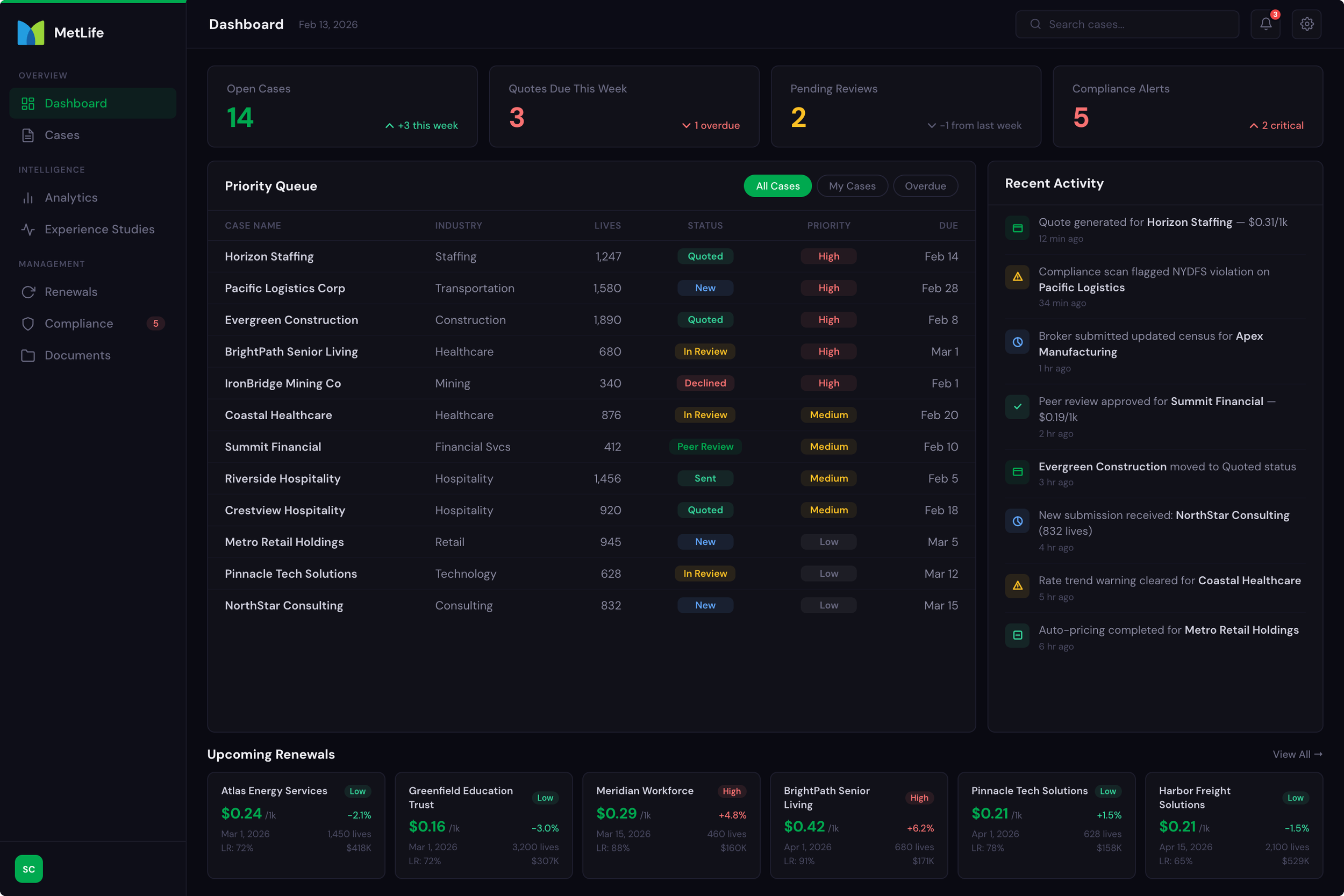

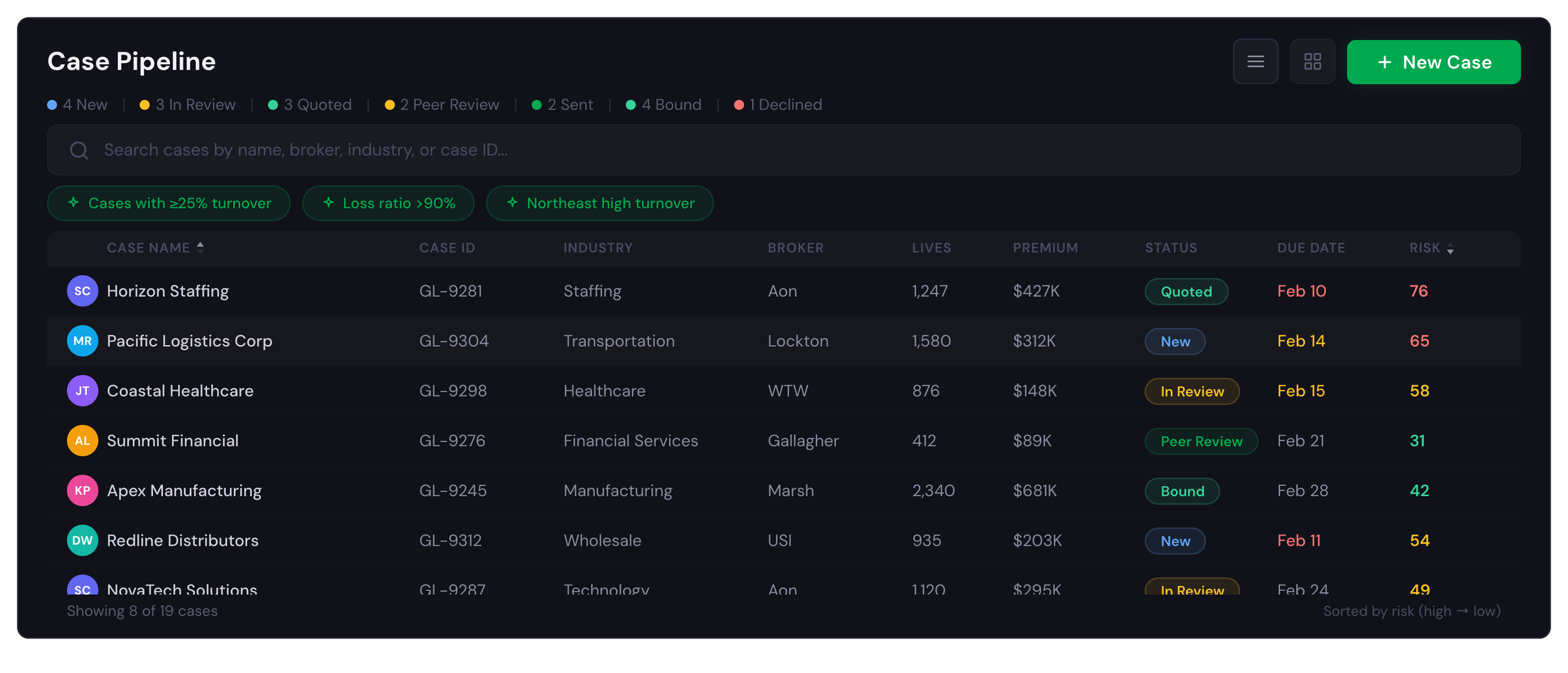

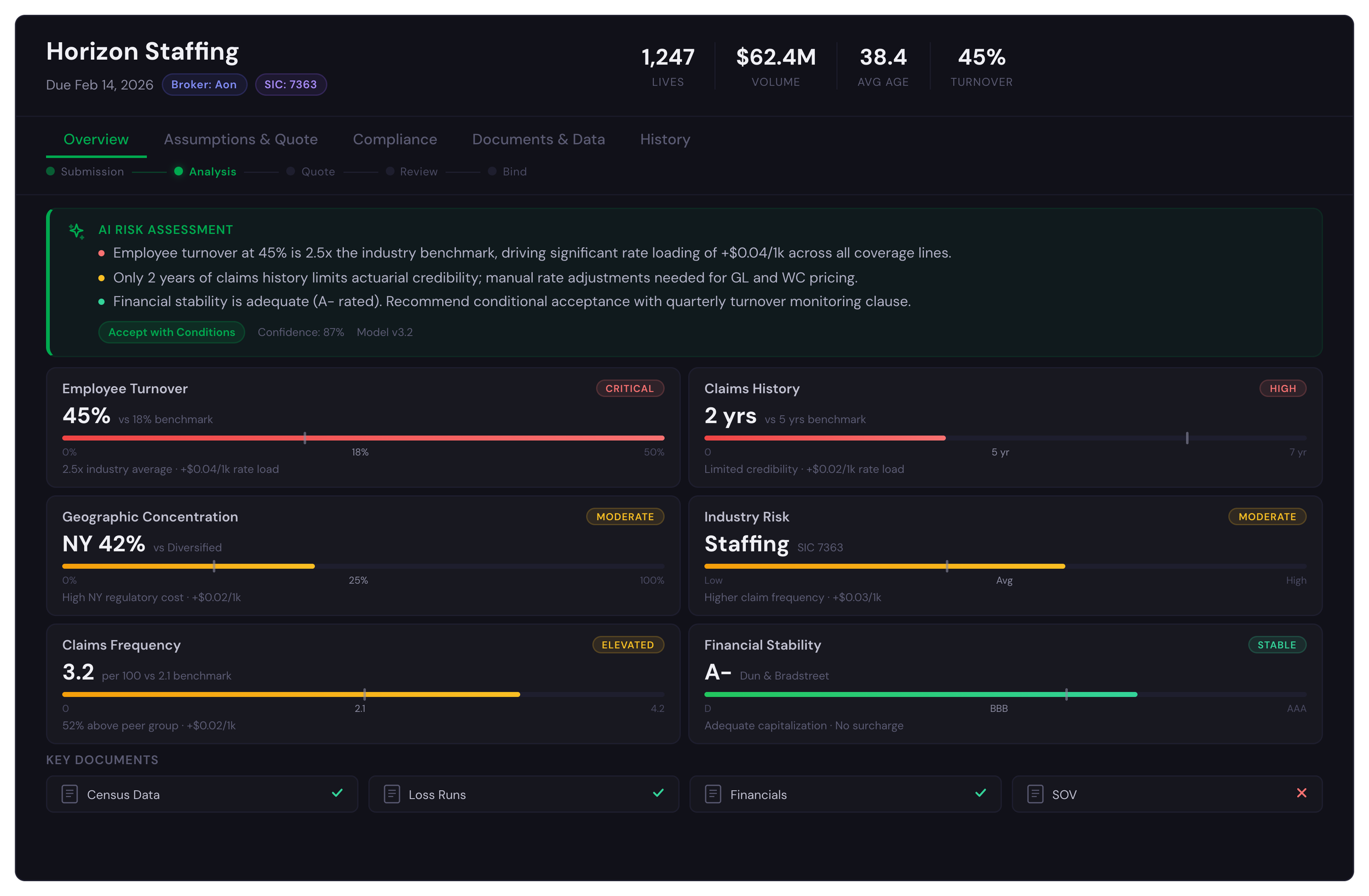

Risk needs to jump the queue

Early designs showed cases in chronological order. Testing revealed actuaries constantly scanned for red flags—high turnover, compliance violations, tight deadlines. I rebuilt the pipeline to surface urgent cases first, with risk scores visible at a glance.

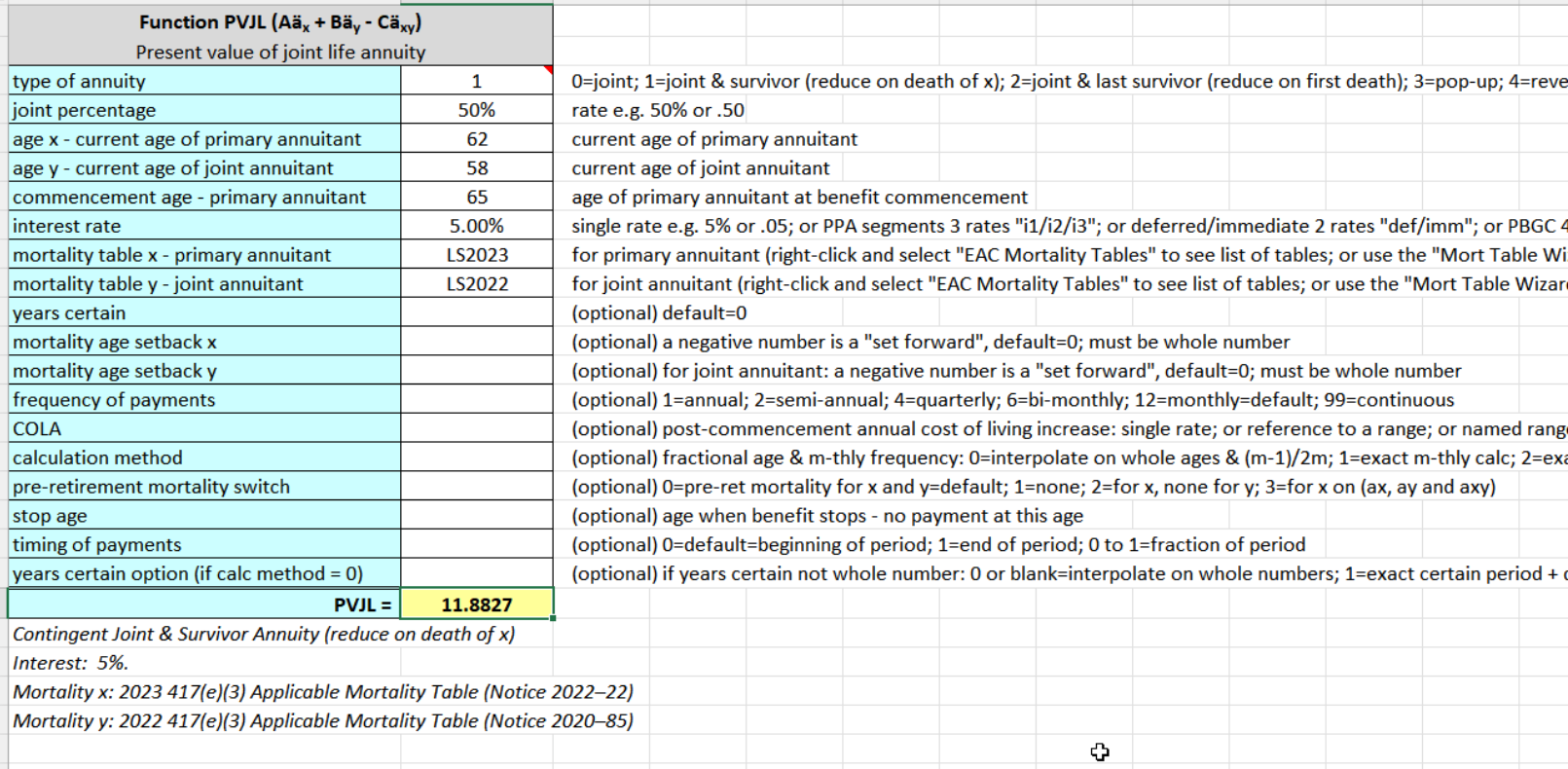

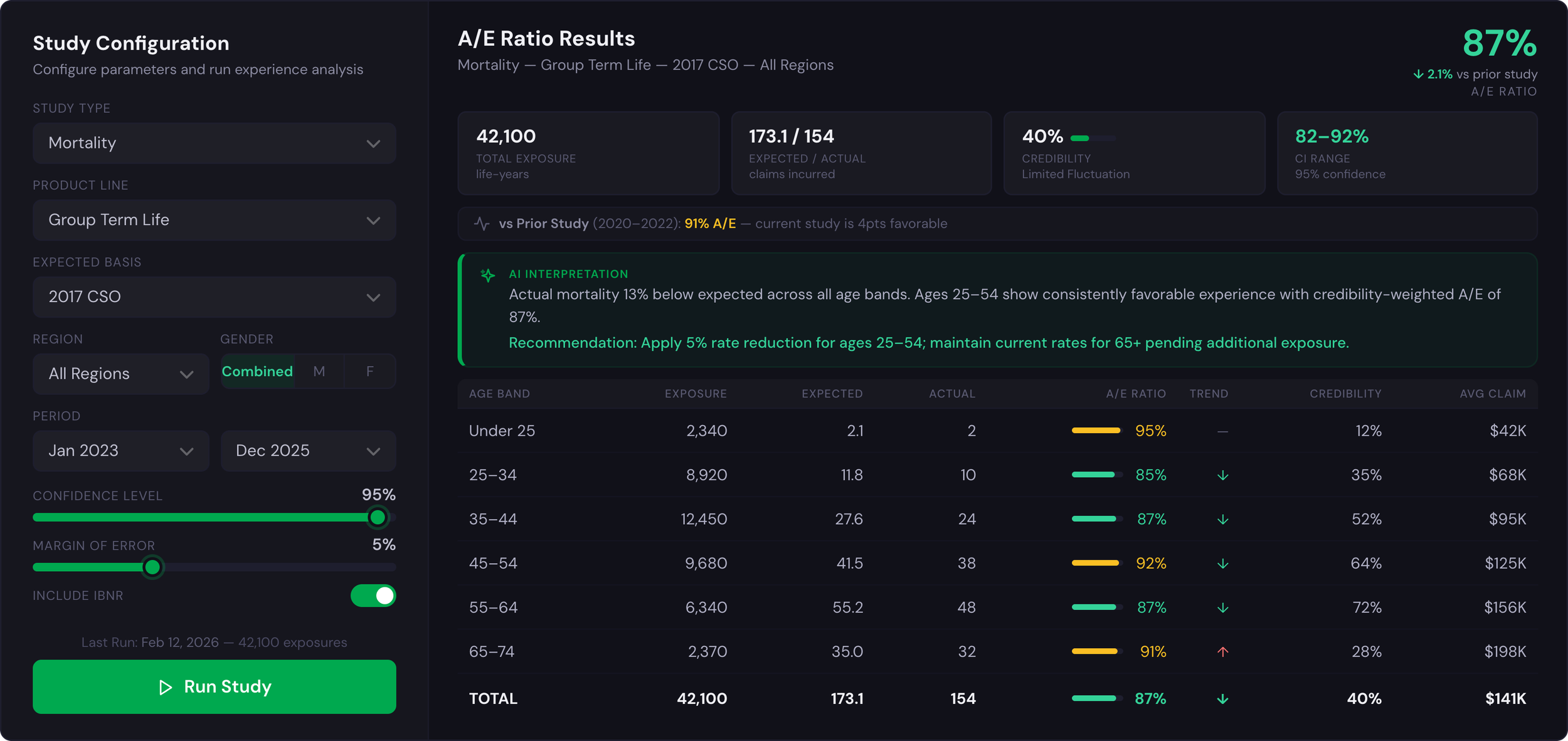

Assumptions need guardrails, not spreadsheets

Junior actuaries struggled to know if their pricing assumptions were reasonable. I identified the need for and designed an experience studies features that show A/E ratios by age band, with AI-generated recommendations and credibility scores. Teams could adjust with confidence instead of hoping they got it right.

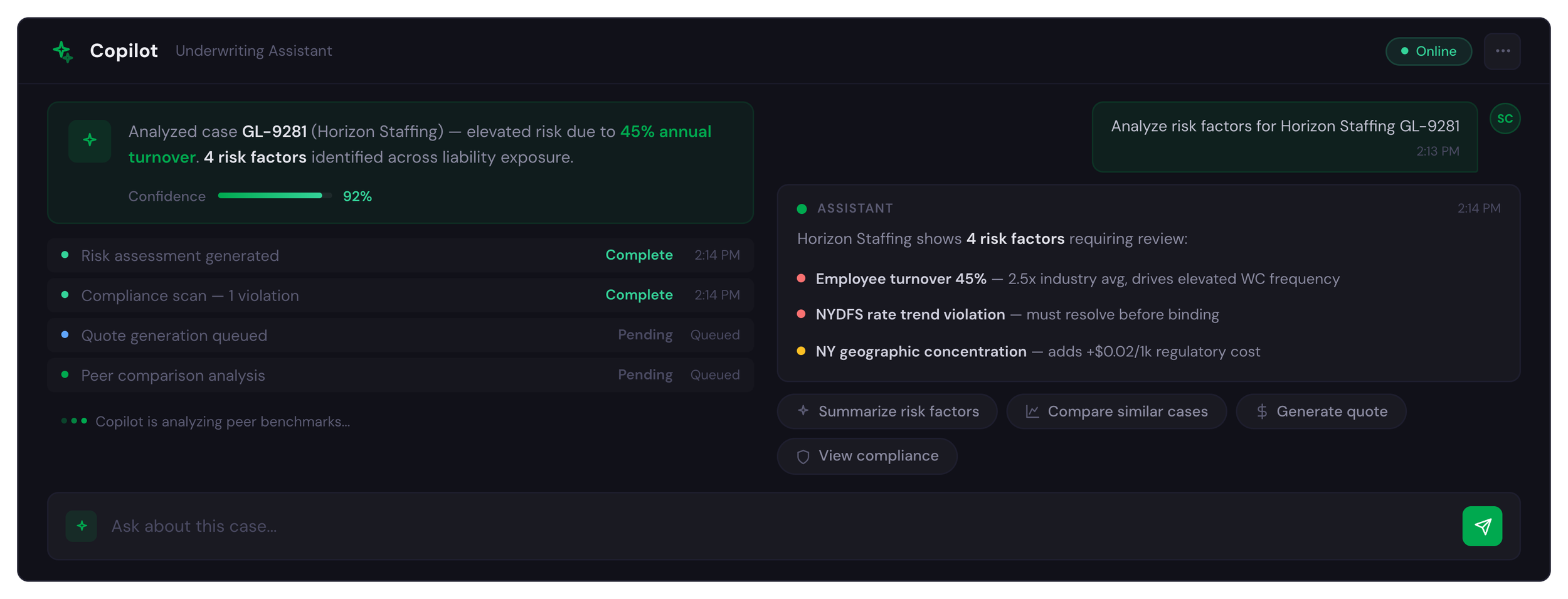

Precedent shouldn't require archaeology

When pricing a staffing case with 45% turnover, the actuary said: "I know we've done this before, but I can't remember where." I designed Copilot to surface similar cases instantly—no folder diving, no asking around. Precedent became a starting point, not a research project.

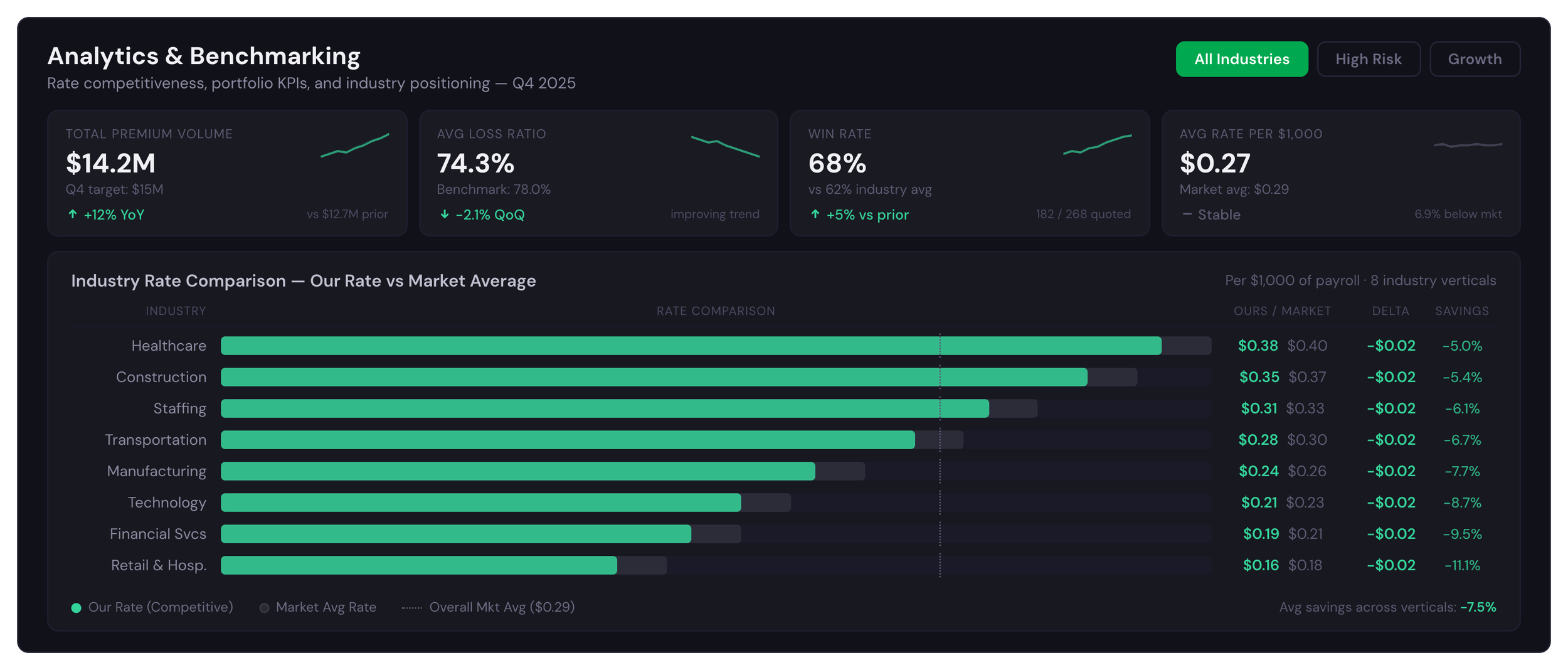

Competitiveness requires context

Actuaries priced in a vacuum, unsure if their rates were too high or leaving money on the table. I designed portfolio analytics that benchmark against industry averages by vertical, showing exactly where they're competitive and where they're losing deals.

Conversation beats queries

Since actuaries had follow-up queries to insights produced around case-specific risk, I designed a Copilot feature to proactively surface urgent patterns and emerging trends, then let users investigate through natural language instead of building filters.